Alinea Customs provide insight into the preparatory steps that are required to comply with the European Union’s new Import of Cultural Goods (ICG) window.

Alinea Customs Briefing – TEFAF takes place in Maastricht, Netherlands, 13 – 16 March 2026. The prestigious art fair brings together over 260 dealers, and spans over 7000 years of art history. Categories include the following: Ancient Art, Antiques, Design, Jewelry, Modern & Contemporary Art, Paintings, Works on Paper Showcase, Focus, and Arts of Africa & Oceania.

2026 will be the first year in which dealers exhibiting at TEFAF Maastricht have to consider the implications of the European Union’s Cultural Goods Act, and the Import of Cultural Goods (ICG) Window.

On 28 June 2025 the European Commission introduced a mandatory digital single trade window for the import of cultural goods into the European Union, the world’s first centralised register of high value art and cultural goods imports.

This report sets out the background to the EU Cultural Goods Act 2019/880 and Commissioning Implementing regulation 2021/1079 and the practical steps that must be taken to ensure compliance.

The ICG is hosted on TRACES NT and represents a digital register of all cultural goods covered by the scope of EU Reg 880/2019 entering the European Union. Therefore, art and cultural objects that are originating outside of the EU and over 250 years in age will require a submission of an importer statement and accompanying photographs to be presented on the ICG. Archeological excavations, and monuments will require an importer licence if they enter free circulation, although they can make use of an importer statement if they enter temporary admission to an art fair.

The ICG application must be made by an entity with a permanent establishment in the EU. If the exhibitor is using an ATA carnet, the importer statement or licence must be made, and included within the “other remarks” field.

Regulation (EU) 2019/880 establishes rules for introducing and importing cultural goods into the EU, aimed at safeguarding cultural heritage. The regulation’s purpose is to combat illicit trade, particularly linked to terrorist financing, tax evasion, and money laundering.

Alinea Customs publish Exporting Fine Art and Cultural Goods to the European Union white paper

Alinea Customs have published a white paper containing detailed insight into the background of the legislation, and the pratical steps that must be taken by companies and private individuals that trade in high value art and cultural goods, to confirm compliance.

Commission Implementing Regulation 2021/1079 delineates procedural requirements for importer licences, importer statements, and evidence of lawful origin. From 28 June 2025, all imports of art and cultural goods within the regulation’s scope must be registered through the EU’s new single trade window portal – the Import of Cultural Goods System.

Alinea Customs have released a white paper providing detailed analysis of the EU Cultural Goods Act, and practical guidance on the steps that must be taken to confirm compliance.

Key areas for exhibitors to be aware of and take preparatory steps to fulfil are set out below.

- Risk Analysis – Do the exhibited goods fall within the scope of the EU Cultural Goods Act?

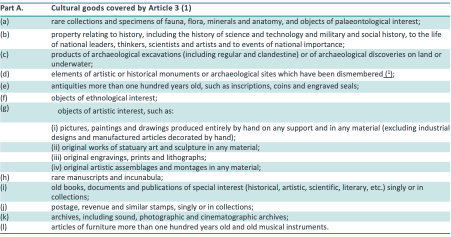

Prohibition

- The introduction of cultural goods that are listed in Part A of the Annex to Regulation (EU) 2019/880 which were removed from the territory in which they were discovered or created, in breach of the laws of the territory is prohibited

- UNESCO Convention 1970 Article 7 establishes a precedent – third countries do not usually enforce external jurisdiction.

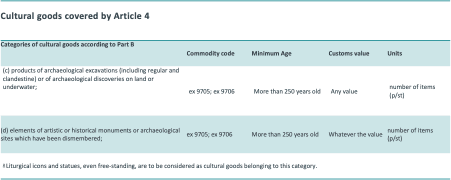

Part B of the Annex to Regulation (EU) 2019/880

The items set out in the adjacent table are deemed to be of higher risk of looting and trafficking and may be imported if a license is obtained prior to entrance into the European Union. They may use an importer statement rather than an import licence in circumstances where they are entering temporary admission when exhibited at an art fair, such as Maastricht.

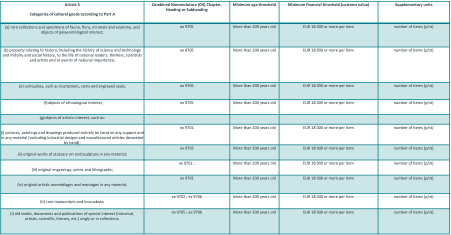

Part C of the Annex to Regulation (EU) 2019/880

Category C identifies paintings, prints, sculptures and coins which are over 200 years old, with a minimum value of 18,000 euros as a residual category. Art and cultural goods that fall within this category must use the ICG window to file an importer statement with accompanying photographs when entering the European Union.

- If the exhibited goods fall within the scope of the EU Cultural Goods Act, do they fall within Part A (prohibited), Part B (may enter an art fair under temporary admission with an importer statement submitted using the ICG, but will require an import licence to be released into free circulation if a sale is made), or Part C (importer statement is required).

The European Union has introduced a single trade window via the Import of Cultural Goods (ICG) platform that will be established from 28 June 2025.

General prohibition – Part A covers cultural goods that were illegally exported from their country of origin at the time of export

Importer license – application is required for goods covered by Part B – movements entering temporary admission to an art fair may use an importer statement

Importer statement– goods covered by Part C

The areas add complexity to the lawful acquisition and sale of cultural artifacts by art dealers.

- If the exhibitor does not have a permanent establishment in the European Union, who will they appoint to act as their representative on the ICG Window (TRACES NT)?

Exhibitors that do not have a permanent establishment in the European Union should appoint a representative in the European Union to act as “holder of the goods” and make the necessary application. They should ensure that an appropriate document set is provided, and that the “holder of the goods” has registered for the ICG window and submitted the statement accompanied by supporting documents prior to shipping.

- If the exhibitor is using an ATA Carnet, have they taken steps to appoint an EU based representative to file the importer statement?

Exhibitors may use ATA carnets to suspend import VAT obligations or alternatively use the temporary admission customs procedure.

Where previously, a security deposit or guarantee for VAT could be secured with the issuing Chamber of Commerce, and the Carnet stamped on exit and entry for each movement of goods, the EU Cultural Goods Act mandates additional requirements. If the holder of the ATA Carnet does not have a permanent establishment in the European Union, they must appoint an EU based representative to act as Holder of the Goods, and fulfil the application for an importer licence or importer statement using the ICG. The reference to the import licence or the importer statement is made in Box 3 (export) or 4 (import) of the ATA Carnet, in the field titled ‘other remarks/autres mentions’.

For expert guidance on exporting fine art and cultural goods to the European Union—including the Import of Cultural Goods Window and required documentation—please contact Alinea Customs.