Alinea Customs Briefing On 10 February 2026, the UK government published secondary carbon border adjustment mechanism (CBAM) legislation containing procedural and administrative information concerning the collation of verified embodied emissions data, carbon price relief, and reporting periods. Further information related to the methodology of the calculation of verified emissions is due to be published in Spring 2026. This information will be useful for organisations, procurement departments, and suppliers to the UK market, that intend to participate in the import goods covered by the scope of UK CBAM from 1 January 2027.

The UK government is conducting a consultation on the secondary legislation with industry stakeholders that closes on 24 March 2026. To participate in the consultation, review the secondary legislation and register your interest: here.

The core policy framework is contained within the primary legislation set out within Finance Bill (No 2) 2025 – 2026, furthered by the secondary draft legislation as follows:

The Carbon Border Adjustment Mechanism (Administrative Provisions) Regulations 2026 (Draft)

The Carbon Border Adjustment Mechanism (Transitory Provision) Regulations 2026 (Draft)

The Carbon Border Adjustment Mechanism Consolidated Tertiary (Draft)

Additional details will be set out in secondary legislation, and gov.uk notices.

Alinea Customs has summarised the key points for stakeholders to be aware of below.

Contains information available under the Open Government Licence v3.0

Information on a return

At the end of each accounting period, the liable person, or their tax agent must complete and submit a CBAM return to HMRC.

If the liable person has imported multiple consignments of the same CBAM good, they must report each consignment separately on the return.

Where the liable person has imported different CBAM goods as part of the same shipment, these must be reported separately on the return.

The following information will be required from the liable person on their CBAM returns, and they must also keep records of this information:

- the CBAM goods imported during the relevant accounting period by reference to the relevant 8-digit commodity code in force when the good passed the tax point, including when a CBAM good is processed into a non-CBAM good in the UK while under a special customs procedure

- the net weight of those CBAM goods in kg at the time of import into the UK

- the embodied emissions in the CBAM good (where not available, a default emissions value would need to be used) in tCO2e

- The embodied emissions in any precursor goods for a CBAM good where these emissions are exempt

- the amount of carbon price incurred on those CBAM goods, if any, in GBP

- for the first accounting period, the quarter in which each CBAM good passed the tax point

- the country of origin of the CBAM good as per non-preferential rules of origin defined by customs

Return amendments and repayments

- The liable person will be able to amend a return to correct an error. A repayment of CBAM liabilities will be allowed where a liable person has made an error on their return that has resulted in an overpayment.

- A repayment claim can be made within 3 years from the date the return is submitted.

- Liable persons must retain sufficient records to substantiate any correction, and HMRC may request evidence before processing a repayment.

Record keeping

Importers of CBAM goods will be required to keep records relating to CBAM.

The following records will need to be held by liable persons for 6 years after the end of the accounting period the goods are attributed to.

Goods imported

Importers of CBAM goods will need to keep records of all CBAM goods imported including commodity code, date of import, value, weight etc. This can be in the form of customs declarations (C88/SAD) or other documents relating to import of goods such as:

- import entry acceptance advice

- bill of lading documents and information concerning the import, export, or declaration of goods by or on behalf of the relevant person

- documents and information concerning the discharge of a customs or export procedure (other than a temporary admission procedure)

- commercial documentation, including records concerning movement of goods within the UK where these are relevant to a customs obligation of the relevant person

- documents and information relating to the calculation of UK customs duty, including evidence of eligibility for any lower rate of duty or relief (this includes temporary admission relief and returned goods relief)

- documents and information relating to any remission or repayment of duty

- documents and information relating to evidence of UK origin that has been provided in relation to exported goods which are then reimported in a complex good to be treated as an exemption

Registration

Liable persons required to register for CBAM will need to a keep record of the information provided in the registration process along with any evidence used to support it.

This will include records relating to the value of CBAM goods imported; the dates these imports occurred and when they triggered the requirement to register; how estimates of the weight of CBAM goods expected to be imported were calculated; and can include any information obtained from a third-party.

Carbon Price Relief

To support their claim for Carbon Price Relief (CPR), liable persons will need to keep the following records:

- evidence pertaining to how the CBAM good was subject to a qualifying carbon pricing scheme

- the verification document pertaining to elements of the effective carbon price

- the headline carbon price of a qualifying carbon pricing scheme and that of Greenhouse Gas Removals (GGRs) if relevant

- the relevant verified information on emissions intensity and the weight of the good if multiplying the effective carbon price by actual embodied data

- evidence of how the CPR in an overseas currency was converted into GBP following HMRC’s requirements

- calculations to support how any of the following was used to determine the CPR claimed on the return

Further information on the required format for submitting the above information will be published within guidance.

Emissions embodied

Where liable persons are providing actual emissions data to determine their CBAM liability, they will need to hold information on the verified emissions intensity for the for each individual CBAM good imported, broken down by the relevant commodity code. Further information on the record keeping requirements when using actual emissions will be set out alongside the published draft legislation in the Spring.

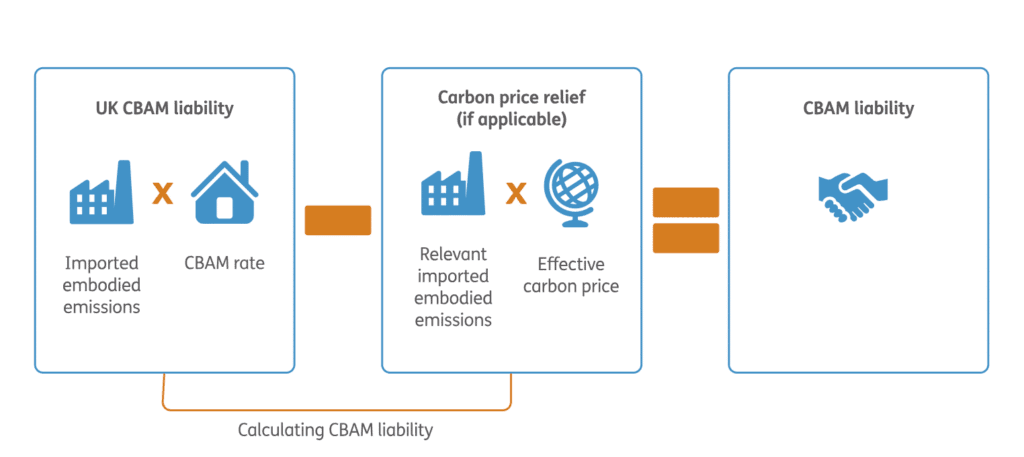

Calculating CBAM liability

The overall approach to determining CBAM liability in Figure 1.

Figure 1: Overview of CBAM liability calculation

- CBAM charge: the CBAM charge which is calculated by multiplying the imported embodied emissions by the CBAM rate

- Carbon price relief (CPR): the CPR which is calculated by multiplying the relevant imported embodied emissions by the effective carbon price

- CBAM liability: CBAM liability which is calculated by subtracting the carbon price relief from the CBAM charge.

The CBAM charge will be based on the direct emissions embodied within the imported CBAM goods. When determining the embodied emissions subject to CBAM, the liable person has 2 options available to them:

- using actual data about the emissions embodied within CBAM goods

- using default emissions values as determined by the government

The government will publish further details on default emissions values in advance of the introduction of CBAM in 2027.

Actual emissions data

When using actual emissions data, the liable person will need to obtain the embodied emissions data from the producer of the CBAM goods. They will need to get this information expressed as tonnes of carbon dioxide equivalent (tCO2e) from their supply chains and hold evidence that these emissions figures have been independently verified.

System boundaries define which direct emissions and production processes are relevant for CBAM goods. They determine, for example, which emissions released from burning gas to heat raw materials fall within scope. In the context of CBAM, direct emissions are only those emissions identified as relevant within the established system boundaries. CBAM system boundaries will reflect UK Emissions Trading Scheme (ETS) system boundaries.

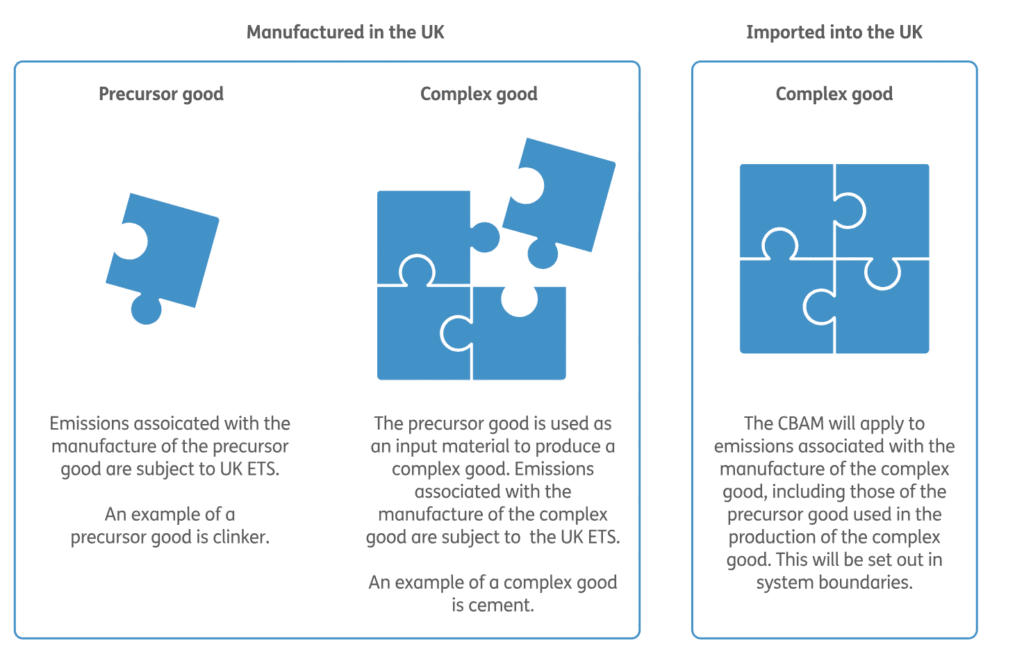

The CBAM charge will also apply to the emissions embodied in relevant precursor goods used in the production of complex CBAM goods. A relevant precursor good refers to an in-scope CBAM good which is used as an input into the production process of a complex good which is also within scope of CBAM. To measure the emissions of a complex CBAM good, it will be necessary to include the emissions embodied in relevant precursor goods.

Figure 2: Emissions treatment for precursor and complex goods

Precursor goods manufactured in the UK: the emissions associated with the manufacture of precursor goods are subject to the UK ETS. An example of a precursor good is clinker.

Complex goods manufactured in the UK: the precursor good is used as an input material to produce a complex good. Emissions associated with the manufacture of the complex good are subject to the UK ETS.

Complex goods imported into the UK: the emissions associated with the manufacture of a complex goods, including those of the precursor good used in the production of the complex good will be subject to the UK CBAM.

All embodied emissions will be measured and reported in tonnes of carbon dioxide equivalent (tCO2e). Verification of emissions data for CBAM will be required by a body accredited by International Accreditation Forum [footnote 1].

In Spring 2026, the government will publish a further set of draft secondary legislation and notices which will cover detail on system boundaries and the monitoring, reporting and verification of emissions for CBAM.

Default emissions values

Whilst it is preferable for the liable person to use independently verified actual emissions data, where this is not possible, the liable person can use default emissions values for CBAM goods.

From 1 January 2027, there will be one default emissions value set per CBAM good. Default emissions values will be published in a notice on GOV.UK in advance of CBAM coming into force. Where required they may be amended or updated by HM Treasury.

Weight

The weight of a CBAM good is required to determine CBAM liability, as it provides the basis for calculating the embodied emissions of an imported good, which forms the basis of the tax charge.

To work out the embodied emissions contained within an imported CBAM good, the emissions intensity of the CBAM good needs to be multiplied by the weight of that good (expressed as tonnes of CO2e).

The liable person will therefore be required to know the weight of the CBAM good they have imported and hold records evidencing how they arrived at his figure.

This must include the weight of the good:

- excluding packing materials and packing containers of any kind

- at the time the good was imported into the UK

- expressed in kilogrammes (kgs)

Records must be kept and must show the weight of the good, along with any evidence relied on to determine that weight. This may include information or documents obtained from another person.

Where it appears that the correct weight has not been provided, or the required records have not been kept, HM Revenue and Customs (HMRC) may determine the weight for CBAM purposes. When doing so, they may make estimates or assumptions, compare the CBAM goods to similar goods, or use any relevant information or documents to help assess the weight.

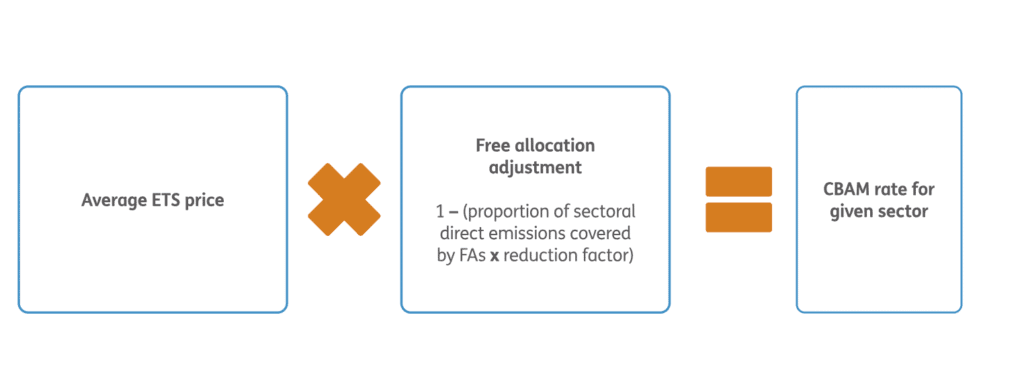

CBAM rate

The CBAM rate is the tax rate that will apply to the emissions embodied in CBAM goods imported into the UK. There will be a single rate per sector in scope of CBAM.

The CBAM rates will reflect the effective carbon price in the UK. The rates will therefore be set in reference to the UK’s primary carbon pricing mechanism, the UK ETS. The headline carbon price under the UK ETS is the same for all sectors. To arrive at a rate per sector, there will be an adjustment to account for the allocation of Free Allowances (FAs) under the UK ETS: the free allocation (FA) adjustment.

This FA adjustment will be based on a sectoral average of emissions covered by FAs over a baseline period, adjusted annually by a ‘reduction factor’ to reflect the phase out of FAs under the UK ETS. The baseline period will only take into consideration years in which there were domestic emissions for that sector. The CBAM rates will be calculated and published by the government at the beginning of each quarter from 1 January 2027. A trial CBAM rate will be set out one quarter before CBAM begins, in Q4 2026.

The relevant CBAM rate for calculating a liable person’s CBAM liability will be the rate for the relevant sector which applied when the CBAM good was imported.

The following diagram sets out the calculation for the CBAM rates, and the subsequent text provides further detail on the different elements of the calculation:

Figure 3: Illustrative example of CBAM rate calculation

This figure shows an illustrative example of CBAM rate calculation. The calculation is comprised of 3 elements:

- The average ETS price, calculated as the mean average of all UK ETS auction clearing prices for the relevant quarter. In a scenario where all ETS auctions fail to clear in a given quarter, the last positive average ETS price will be used.

- The free allocation adjustment, which is calculated as 1 minus the average proportion of sectoral direct emissions covered by FAs, multiplied by a reduction factor. This average is determined by using UK ETS baseline data reporting data related to the average sectoral direct emissions generated in 2019, 2022 and 2023 by sub-installations producing CBAM goods, and average FAs allocated to those same sub-installations over the same period. Years will be discounted if there were no direct emissions for that sector. The reduction factors will reflect the reduction factors applied to phase out FAs under the UK ETS.

- The final output is the CBAM rate for the given sector for that quarter.

Carbon price relief

The liable person can claim Carbon price relief (CPR) which will reduce their CBAM liability if the embodied emissions in the CBAM goods they have imported have been subject to a qualifying carbon pricing scheme and they have the necessary verification documents, as well as other relevant information, to calculate the amount of CPR. This includes where a CBAM good has been subject to more than one qualifying carbon pricing scheme and/or produced in more than one installation within the same jurisdiction.

The total relief claimed cannot exceed the amount of CBAM liability due.

Qualifying schemes

A qualifying carbon pricing scheme must meet the following criteria:

- it is administered by a tier of government at city, national or regional level or by a supra-national organisation

- the use of the revenue collected by or on behalf of the scheme is determined by the relevant tier of government or supra-national organisation

- participation for installations that manufacture or process a CBAM good is mandated by law, including in instances where mandatory participation is after installations emit a specified amount of emissions

- the rules and scope of the scheme, as well as the headline carbon price of the scheme, are publicly available

- the scheme imposes a cost on the relevant emissions produced by participants of the scheme either directly or indirectly. In the case of the latter, the scheme must use emissions factors taken directly from or calculated using the methodology of any of the following sources:

- the Intergovernmental Panel on Climate Change

- the International Energy Agency

- the United Nationals Framework Convention on Climate Change

CPR emissions data will need to be verified by a body accredited by a full member of the Global Accreditation Cooperation Incorporated (GACI). GACI replaces the International Accreditation Forum.

What is required to calculate CPR

It is the responsibility of the liable person to calculate the CPR In order to do so, they will, as specified below, need to use a combination of verified information and publicly available information, to do so, they will need:

- a completed verification report, in the form of a template that will be provided by HMRC. The report will need to be acquired from the installation that manufactured or processed the CBAM good for which relief is being claimed. It will need to be completed by a suitably qualified verification body and include the following information:

- the quantity of relevant emissions (those emissions within system boundaries) produced by the installation (in which the good was produced) in tCO2e

- a breakdown showing which elements of the qualifying carbon pricing scheme are applicable to the relevant elements. This will vary between schemes and may include a breakdown of emissions subject to the headline carbon price, FAs, thresholds, graduated carbon prices, or greenhouse gas removal schemes

- the monetary support that the installation in which the goods were produced has received or is due in relation to the emissions emitted by the installation (if applicable)

- in instances where the qualifying carbon pricing scheme prices emissions indirectly, information on the emissions factors used

- the publicly available headline carbon price of the qualifying carbon price the CBAM good was subject to and, if applicable, the price for greenhouse gas removals. The headline carbon price, if not fixed, must be calculated by the liable person as the mean average from the quarter before the quarter in which the CBAM good was imported

- data on the emissions embodied in the CBAM good for which relief is being claimed. This can be either actual emissions data or the applicable default value

If within a qualifying carbon pricing scheme an installation has used greenhouse gas removal credits or similar to fulfil its obligations, the rules allowing for this and the price of such credits or similar must be publicly available. If this is not the case, the price of any greenhouse gas removal credits or similar cannot be used to generate CPR.

Compensation must be accounted for in the calculation if it is connected to the emissions emitted by the installation subject to the qualifying carbon pricing scheme and the rules of the compensation scheme are publicly set out by the jurisdiction of the qualifying carbon pricing scheme.

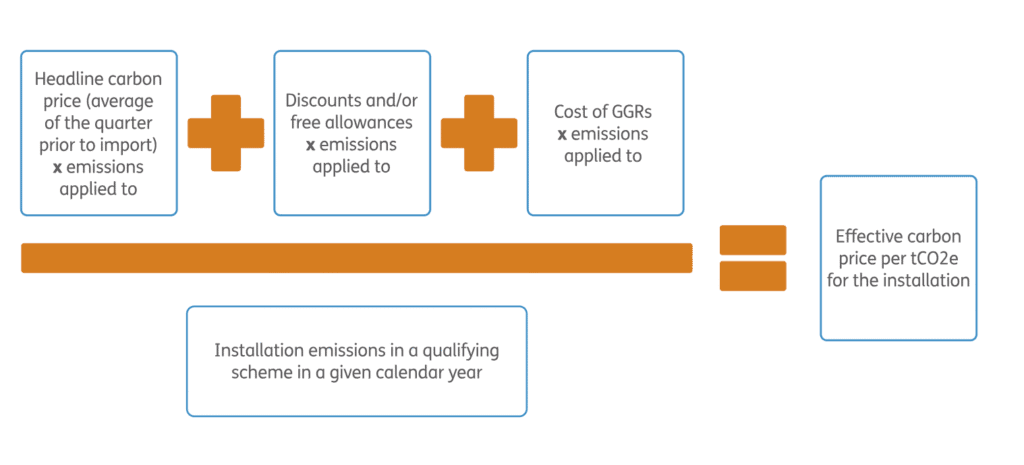

How to calculate CPR

The information above should be used by the liable person to calculate the CPR in accordance with the following steps:

- Identify the relevant emissions in tCO2e produced by the installation in a given calendar year in line with CBAM requirements.

- Identify the amount of emissions in Step 1 that were subject to different elements of the qualifying carbon pricing scheme.

- Multiply the amount of emissions attributable to each relevant element of the qualifying carbon pricing scheme (those elements that meet specified transparency criteria)) by the applicable price per tonne of carbon dioxide equivalent, disregarding monetary support, for those emissions and add them together.

- Divide the Step 3 total by the Step 1 emissions figure to produce an overall price per tonne of carbon dioxide equivalent — this is the effective carbon price, subject to any adjustment in accordance with step 5.

- If applicable, adjust the step 4 price to account for monetary support/compensation the installation received in relation to emissions. To do this, divide the total compensation/rebate received for the same calendar year as in Step 1 to get the effective carbon price for compensation and deduct this from the Step 4 price.

- Multiply the effective carbon price by the embodied emissions of the relevant good. The embodied emissions may be determined using default values, provided the latter was used to calculate the CBAM rate liability.

Figure 4: Illustrative example of effective carbon price calculation (steps 1 to 4)

This figure shows an illustrative example of the effective carbon price calculation. It is expressed as a price per tCO2e in the currency used by the qualifying carbon pricing scheme. The calculation may vary depending on the qualifying scheme the CBAM good was subject to, and how installations interact with that scheme.

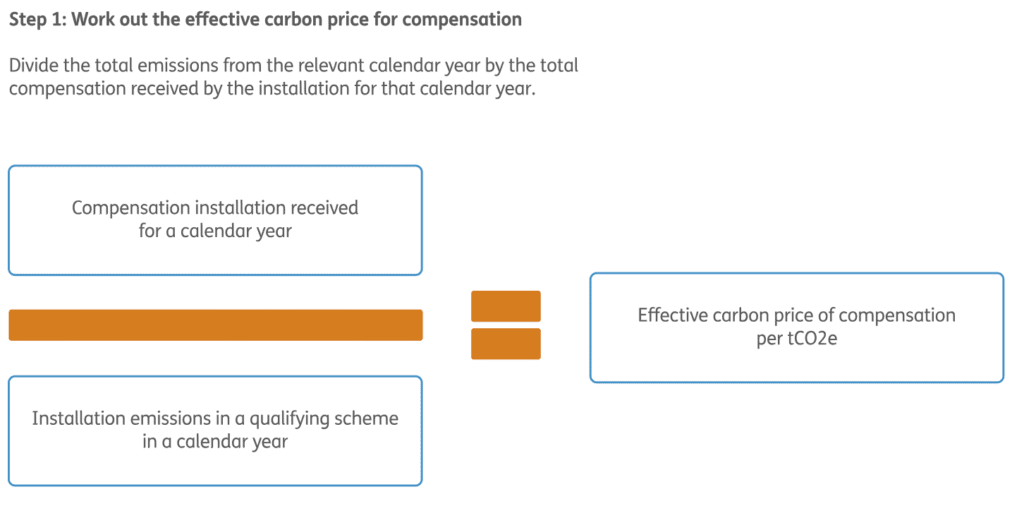

Figure 5: Step 1 — Illustrative example of adjusting the effective carbon price for compensation and rebates (step 5, if applicable)

Figure 5: Step 2 — Illustrative example of adjusting the effective carbon price for compensation and rebates (step 5, if applicable)

This figure shows an example of how the effective carbon price should be adjusted when an installation has received rebates and/or compensation linked to its emissions.

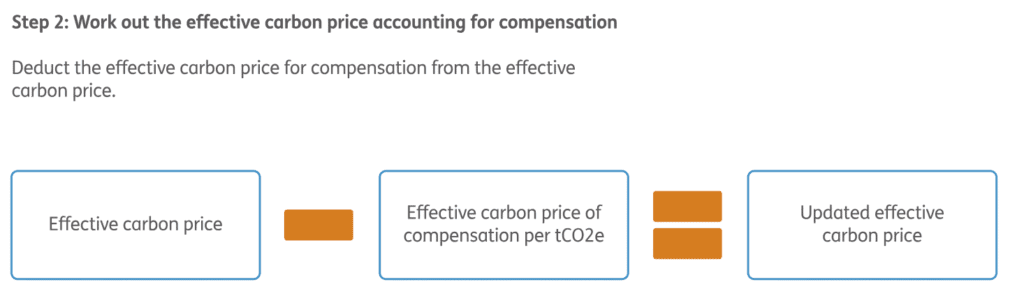

Figure 6: Illustrative example of CPR calculation (step 6)

This figure shows an example of how to calculate CPR. It uses the effective carbon price from figure 3 (or 4, where applicable) and multiplies it by the embodied emissions for the CBAM good. The result is the CPR.

Where a CBAM good has been subject to more than one qualifying carbon pricing scheme, including where a CBAM good has been produced using precursor goods that were subject to different qualifying carbon pricing schemes, the CPR for each price incurred must be calculated separately.

Currency conversion for CPR

For liable persons to deduct CPR from their CBAM liability, any relief amount calculated in an overseas currency must be converted into pounds sterling (GBP). To do this, the liable person must use the exchange rates published by HMRC for the calendar quarter prior to the import of the CBAM good.

For example, if a good is imported in June 2030, the liable person must use the exchange rate published by HMRC for the period covering January to March 2030.

Where a CBAM good has been subject to multiple qualifying carbon pricing schemes, including where a CBAM good has been used in the manufacture and processing of another CBAM good, the liable person must convert to GBP before entering them into the return.

CPR can only be claimed where the relevant elements used to calculate the effective carbon price have been appropriately verified.

This verification must be carried out by an independent verifier who:

- is accredited to the relevant standards specified:

- ISO 17029: General principles and requirements for validation and verification bodies.

- ISO 14064-3: Greenhouse gases — part 3, specification with guidance for the validation and verification of greenhouse gas assertions.

- ISO 14065: General principles and requirements for bodies validating and verifying elements.

- ISO 14066: Environmental information — competence requirements for teams validating and verifying environmental information.

- is accredited by an accreditation body which is a full member of the Global Accreditation Cooperation Incorporated.

- is independent of the installation for which the person is verifying elements of the effective carbon price

- is independent of any government or supra-national institutions administering a qualifying carbon price

Further detail on the methodology for calculating and verifying the effective carbon price will be published in guidance.

A list of commodity codes covered by the scope of UK CBAM is available from the following link.

The Policy Summary is available from: https://www.gov.uk/government/publications/carbon-border-adjustment-mechanism-cbam-policy-summary/carbon-border-adjustment-mechanism-cbam-policy-summary

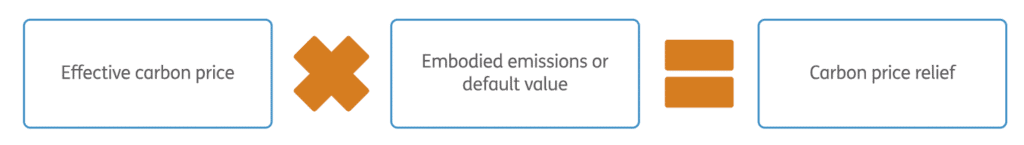

Establish Working Practices and Internal Controls

Although the UK Government has released consultations, draft legislation and confirmed CBAM, several elements of the UK’s CBAM framework remain subject to clarification. In particular, the default values for embedded emissions has not yet been finalised.

Until the final legislation and technical guidance are published, companies should:

- Maintain a standing CBAM risk register, updated as government guidance evolves

- Introduce contractual clauses requiring suppliers to cooperate with CBAM reporting and provide emissions data when requested

- Set up internal ownership within procurement, finance and legal teams to monitor developments

- Prepare to implement a standardised data-collection template aligned with future UK calculation rules

- Train procurement staff on identifying CBAM-scope commodities and interacting with suppliers on emissions-related matters

Alinea Customs is an IACBAM 3003:2025 accredited trainer, supporting organisations with the implementation of IACBAM trading standards for CBAM.

We provide:

- CBAM implementation support aligned with IACBAM standards

- Monitoring and risk mapping of in-scope commodities

- Procurement and contractual advisory through our in-house legal team

- Supply chain education to reduce exposure and manage carbon cost risk

Early supply chain education and compliance is critical to avoid penalties and limit financial exposure.

Contact Alinea Customs today to safeguard your CBAM strategy.