Find Us

Alinea Customs,

Dowgate Hill House,

14 – 16 Dowgate Hill,

London,

EC4R 2SU

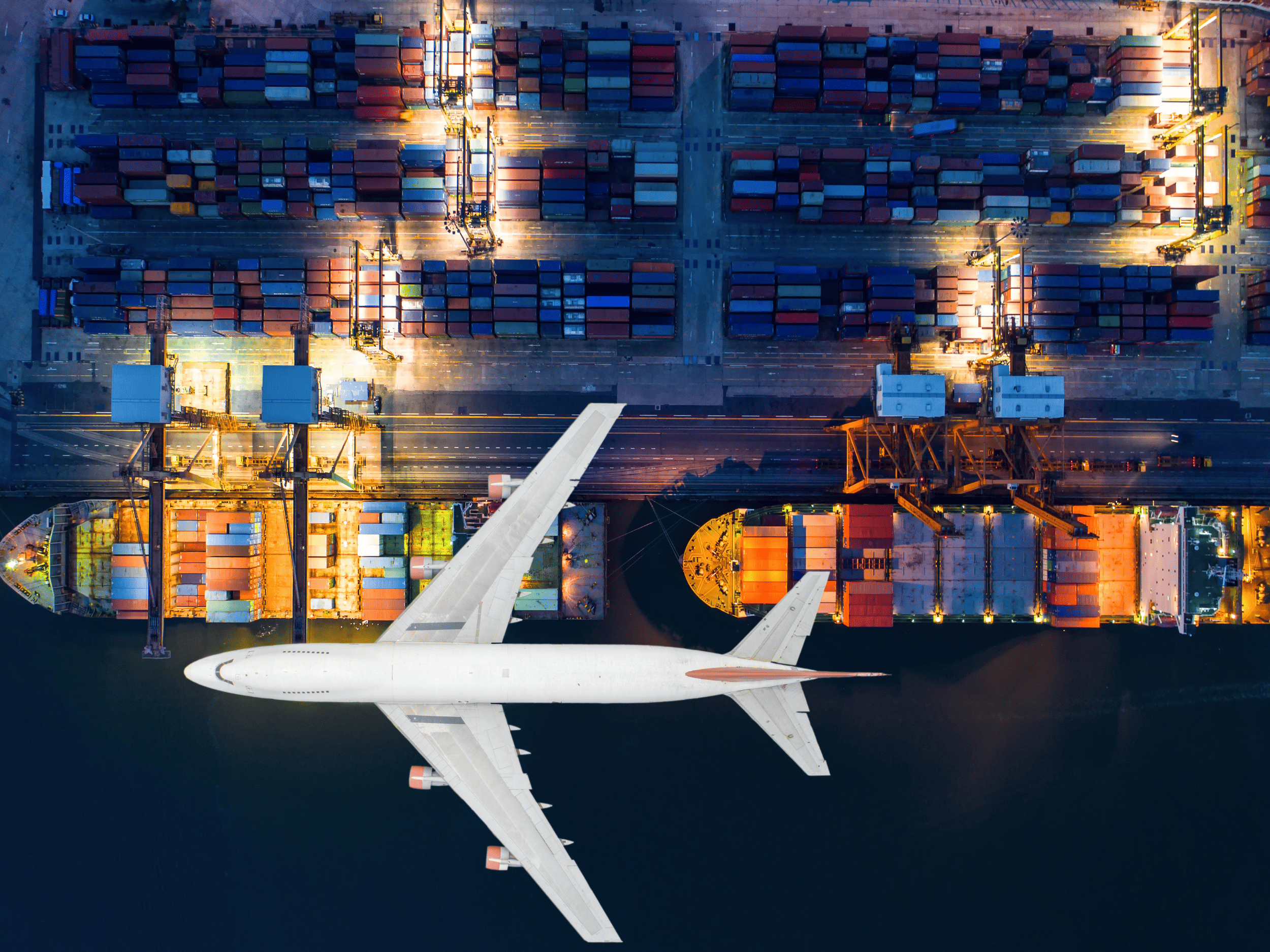

Dedicated support with UK customs clearance. The value of UK total trade is £1,419.3 billion per year. Customs declarations are a mandatory requirement to move goods across the borders, but the complexities of areas such as tariff classification, customs valuation, claiming preference, and Incoterms can be challenging for traders.

Alinea Customs provide full support across all areas of UK border compliance and administration. Our clients benefit from competitive rates, efficient clearance and access to qualified legal expertise to assist in navigating the complexities of global supply chains, and in accessing the benefits of international trade deals, and international trade policies.

Alinea Customs provide administration of import clearance at ports across the UK, and provide the documents required to maintain a full audit trail for HMRC, which we advise to retain for 4 years.

Trade clients are allocated an account manager and benefit from a direct line, competitive rates, and a fast turnaround on customs clearance from our professionally trained staff.

Alinea Customs provide administration of the export administrative document (EAD) at ports across the UK, and can issue transit documents from port of Dover.

Export declarations will be either prelodged or arrived, according to the type of port, and we can provide evidence of export to zero-rate VAT upon request.

Alinea Customs provide professional insight into supply chain co-ordination, accessing the benefits of international trade deals and developing countries policies such accessing zero-quota allowances to support economic growth.

Key areas of specialist insight include construction, clothing, food and perishables, engineering, and manufacturing.

Assistance with the provision of non-reserved legal services, such as drafting contracts and providing legal advice on customs legislation.

Alinea Customs' inhouse solicitor has over 20 years' experience across a range of industries including oil and gas, engineering, aviation, and telecoms, with a focus on procurement and cross-border trade and international logistics.