From 1 January 2027, the UK Carbon Border Adjustment Mechanism (CBAM) will place a carbon price on some of the most emissions intensive industrial goods imported to the UK from the aluminium, cement, fertiliser, hydrogen and iron and steel sectors that are at risk of carbon leakage.

Large scale infrastructure plans for energy, structural engineering, and construction projects are usually subject to contract in advance of the design and build occurring, and imports arriving in the United Kingdom. Due to this, engineering directors, procurement directors, logistics managers and financial management may seek to assess their commercial exposure to CBAM understand the implications of the CBAM on imports into the United Kingdom and pricing implications.

This article will provide insight into CBAM, the scope of the commodities that will be impacted, and reporting obligations.

The UK government published a consultation on CBAM on 13 March 2024. This document contained a list of commodity codes that would be subject to carbon emissions tax from 1 January 2027. Subsequently, on 25 April 2025 the new incumbent Labour government published an update that the UK CBAM would align more closely with the EU CBAM and would not include ceramics and glass within the initial scope of the products subject to the carbon emission tax.

Alinea Customs have provided a downloadable excel file with a table of commodities that will be in the scope of CBAM.

The UK government published the primary legislation for technical consultation on 24 April 2025. This draft legislation was shared for review with stakeholders within the sector. The consultation took place between 24 April – 3 July 2025.

Frequently Asked Questions (FAQ)

Why is the UK government imposing CBAM?

The imposition of CBAM is due to various factors. This includes the United Kingdom’s commitments to reduce carbon emissions to net zero by 2050 made to with The Climate Change Act 2008 (2050 Target Amendment) Order 2019 (S.I. 2019/1056), arts. 1, 2. It is also a protectionist measure, designed to level the market to ensure that UK producers and manufacturers are not disadvantaged due to the UK’s climate emissions commitments causing their cost of production to be inflated.

Currently, as discussed with the Whitepaper ‘Analysis of the Interaction between Policy Concerning the Decarbonisation of the UK Constructional Steel Industry and Private Regulation’ the Greenhouse Gas Emissions Trading Scheme Order 2020 establishes the UK Emissions Trading (ETS) scheme, hosted by ICE Futures Europe (ICE). The ETS requires that the UK’s carbon intensive industries beyond a specified free allowance[1] must purchase carbon credits at auction to offset their emissions. The amount of carbon credits available is capped and reduced on an annual basis, whilst enabling businesses with a predictable timeframe in which to adapt to responsible practices.

This has led to elevated costs reflected in pricing for industries that fall within the remit of Greenhouse Gas Emissions Trading Scheme Order 2020, which has resulted in an increase in procurement of imported products manufactured by carbon-intensive industries from regions which are not subject to similar environmental targets.[2]

The concept of CBAM was initially adopted by the European Union (EU), to create a fair price on carbon emitted during the production of carbon-intensive goods that enter the EU market, and to encourage cleaner, less carbon-intensive industrial production in exporting regions. The EU has currently initiated a transitional phase between 2023 – 2025, whereby importers are required to submit CBAM reports. The EU will impose a CBAM tax regime from 1 January 2026, one year prior to the UK.

How will carbon emissions tax be calculated?

The following information outlines how CBAM rates will be calculated. To avoid double taxation, any carbon emissions that has been paid in the country of production will be deducted from the final value.

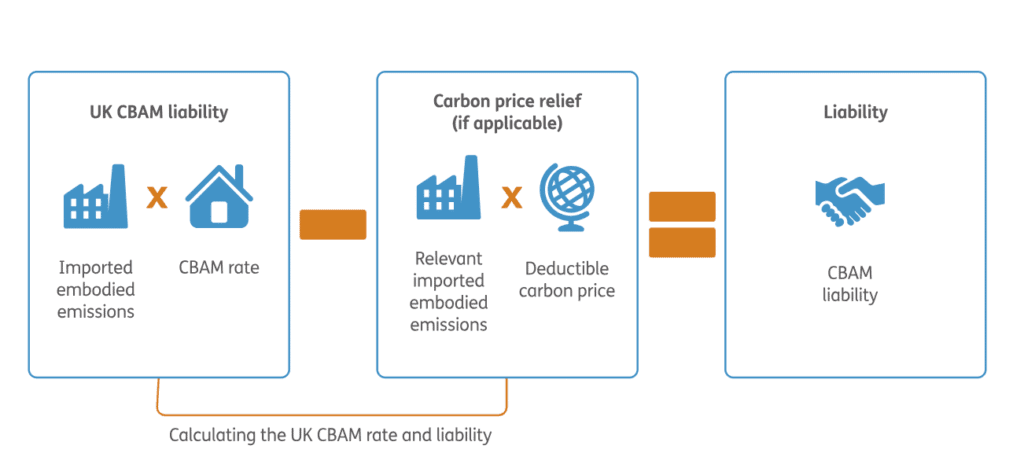

Figure 1

Contains public sector information licensed under the Open Government Licence v3.0.

This figure shows the calculation for the CBAM rate and liability. The calculation is comprised of 3 elements:

- the UK CBAM rate which is calculated by multiplying the imported embodied emissions by the CBAM rate

- the carbon price relief which is calculated by multiplying the relevant imported embodied emissions by the deductible carbon price

- CBAM liability which is calculated by subtracting the carbon price relief from the UK CBAM rate

Emissions Measurement

The CBAM charge will be based upon the emissions that are embodied within the imported CBAM goods. These are divided into two types of emissions:

- Direct emissions

- Indirect emissions

At the Autumn Budget, the UK government has published that CBAM will apply to direct emissions embodied in imported CBAM goods, including those emissions embodied in relevant precursor goods at a point further up the value chain. The inclusion of indirect emissions within scope of CBAM will be delayed until 2029 at the earliest. This is to reflect continued support for the Energy Intensive Industries (EII) Compensation Scheme.

Direct emissions are emissions that occur as a result of the production process of CBAM goods. These may include emissions released when burning gas to heat raw materials, and also release during the cooling process. They are relevant whether the processes occurred on site or off site.

Indirect emissions are related to the generation of electricity, where the electricity is subsequently consumed during the production of CBAM goods. These emissions are relevant irrespective of whether the electricity was produced on sire or off site.

The CBAM charge is also applicable to emissions embodied in relevant precursor goods used in the production of complex CBAM goods. A relevant precursor goods refers to an inscope CBAM good which is used as an input into the production process of a complex good which is also in the scope of CBAM. The emissions embodied in relevant precursor goods are must be included in the measurement of the emissions of a complex CBAM good.

On this basis, comparable coverage to the UK’s ETS will be established. The UK government have published an intention to provide further detail on emission measurement, including the system boundaries of CBAM, confirmation of those CBAM goods deemed to be precursor goods and the mapping of relevant precursor goods to resulting complex CBAM goods in delegated legislation.

The embodied emission will be measured and reported in tonnes of carbon dioxide equivalent (tCO2e).

When determining the embodied emissions subject to CBAM, the liable person has 2 options available to them:

- using actual data about the emissions embodied within CBAM goods

- using default emissions values as determined by the UK government

From 1 January 2027, there will be one default emissions value set per CBAM good. After 2027, the government is considering the feasibility of moving to an alternative approach for default emissions values. Default emissions values will be published in delegated legislation in advance of CBAM coming into force. They may be set for a single year or multiple years. Where required they may be amended or updated by HM Treasury (HMT).

Verification of emissions data for CBAM will be required by a body accredited by an International Forum Member. The accreditation does not have to be by a body in the country where the CBAM goods are produced, meaning that emissions from countries without accreditation can be verified by any accredited body.

Weighing

The liable person will be required to maintain records of the net mass of the imported CBAM goods. This information will be required when CBAM reporting.

CBAM Rates

The CBAM rate is the tax rate that will apply to the emissions embodied in CBAM goods imported into the UK. There will be a single rate per sector in the scope of CBAM. These rates will reflect the effective carbon price in the UK, and will be established by reference to the UK’s domestic carbon pricing mechanisms. These include the UK ETS, the UK’s primary carbon pricing mechanism, and the Carbon Price Support (CPS) will is applicable to fossil fuel used to generate electricity in the UK.

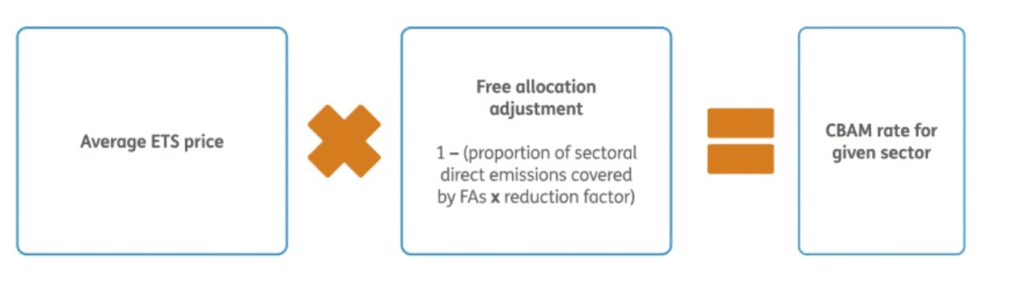

Figure 2: Illustrative example of CBAM rate calculation

Contains public sector information licensed under the Open Government Licence v3.0.

This figure provides an illustrative example of CBAM rate calculation. The calculation is comprised of 3 elements:

- The Average ETS price

- The free allocation adjustment which is calculated by multiplying the direct emissions by the UK ETS reference price, the sum of which is then multiplied by 1 minus any free allocation adjustment

- the calculation is the final output of CBAM rate calculation, which is CBAM rate for the given sector

Definition of terms in Figure 2:

- direct emissions price: as the UK ETS and free allowances (but not the CPS) apply to direct emissions, the direct emissions price will be calculated by taking into account the UK ETS reference price, adjusted to reflect any free allowances available within the sector over the most recent scheme year for which there is complete data (see below)

- Average UK ETS reference price: This will be calculated by taking the average auction price under the UK ETS from the previous quarter. This allows the CBAM rate to track the changes in the UK ETS price across the year, whilst giving the liable person certainty on the CBAM price they will pay for their consignments in each accounting period. In the event that there is no auction clearing price from the previous quarter, HMT will be able to set the ‘UK ETS reference price’ by discretion with reference to certain criteria

- Free Allocation Adjustment: this will be calculated based on the free allowances available to domestic industry under the UK ETS over the most recent scheme year for which there is complete data. There will be a free allocation adjustment per sector in scope of CBAM to produce a CBAM rate per sector. The adjustment will ensure that the CBAM rates reflect the effective price paid by domestic producers

- CPS rate: This will be determined by reference to the CPS rate for the current quarter’; however, the CPS rate will not change more frequently than once per year on 1 April

Carbon Price Relief

Carbon price relief will occur if the imported CBAM goods have previously been subject to a deductible carbon price. The government have published that only explicit carbon prices that place a value per tCO2e directly on greenhouse gas emissions produced within a process can be deducted from a person’s CBAM liability. These will either take the form of an ETS scheme with a market-based price, or a fixed price carbon tax.

The liable person will be required to hold evidence of all carbon price deductions that they claim on their return.

Customs Declaration and Tax Point

The tax point is the where the CBAM charge arises. The tax point will arise when a customs declaration becomes “arrived” when the goods enter into the free circulation customs procedure in the UK.

Special customs procedures

Where CBAM goods are declared for a special customs procedure, they may undergo processing or storage prior to enter into the UK. This could include:

- a storage procedure (free zones)

- an inward processing procedure

- an authorised use procedure (or Union end-use procedure).

Where a CBAM goods is processed into a non-CBAM goods in a special customs procedure, a CBAM charge will still arise when the non-CBAM good passes the tax point. However, the CBAM liability will be based on the original CBAM good that entered the procedure, prior to processing.

In circumstances where a CBAM good is processed into a good which is another CBAM good, the CBAM charge will occur when the new processed good passes the tax point, and the CBAM liability will be based upon the CBAM good which passes the tax point.

Where the CBAM good is processed and exported prior to entering free circulation, there will be no CBAM liability.

In all cases, the value of the CBAM good which the CBAM charge is based upon will count towards the £50,000 minimum registration threshold.

Goods processed outside the UK

CBAM goods can be processed outside of the UK under the outward processing customs procedure, or when a good leaves Northern Ireland to be processed in the EU prior to being returned to Northern Ireland.

If the good is processed and returns to the UK as a CBAM good the CBAM charge will arise when the good enters free circulation. However, if the original good was a CBAM good subject to a carbon price in the UK, that price can be deducted to adjust the CBAM liability down. Only the difference in value between the original good and the processed CBAM good will count towards the £50,000 minimum registration threshold.

Where a CBAM goods is exported for outward processing and returns as a non CBAM good, there will be no CBAM liability.

Returned Goods Relief

Where a CBAM good is imported into the UK and qualifies to enter the returned goods relief customs procedure, no CBAM liability will be incurred.

There will also be no CBAM liability for Union goods exported from Northen Ireland into the EU and reimported into the UK providing the goods is:

- reimported within 3 years of export from Northern Ireland; and

- returned in the same state in which it was exported

Where these conditions are met, the returning CBAM good will not need to be declared on a CBAM return or be factored in the calculation of the minimum registration threshold of £50,000.

Liability

The party responsible for CBAM is the importer of the goods. In circumstances where the declaration is made on behalf of another party, the importer is the party on whose behalf the declaration is made.

Private individuals importing CBAM goods for non-commercial purposes will not be liable for CBAM. Commercial imports that meet the CBAM liability test will be liable for CBAM.

The importer may appoint a tax agent to submit a CBAM return on their behalf. The tax agent cannot register for CBAM and no liability will be attached to the tax agent.

Accounting periods, returns, payments and repayments

The liable person will need to complete and submit an online tax return for CBAM subsequent to the end of the accounting period from the time they become liable for registration, until they meet the criteria for deregistration.

Where the party has nil liability because they did not import any CBAM goods during an accounting period, or the liability was zero because the goods that they had imported were subject to a higher deductible carbon price, they will still need to complete and submit a CBAM for each accounting period, once they have registered.

The first accounting period for CBAM will be 12 months from 1 January 2027 until 31 December 2027. Returns and payments will be due 5 months from the end of the first accounting period (31 May 2028). Following a consultation, the government has reported that from 1 January 2028, the accounting periods for CBAM will move to quarterly, with a two month return and payment window. HMRC may further extend the return and payment deadline during the first quarterly accounting period to support businesses with the transition to quarterly accounting, and to ensure that the two payment periods do not overlap.

Information on Return

The following information will be required from the liable person on their CBAM returns:

- the CBAM goods imported during the relevant accounting period by reference to the commodity code in force when the good passed the tax point, including when a CBAM good is processed into a non-CBAM good in the UK while under a special customs procedure

- the weight of those CBAM goods

- the total emissions embodied in those CBAM goods (where not available, a default emissions value would need to be used)

- any effective deductible carbon price incurred on those CBAM goods

- for the first accounting period, the quarter in which each CBAM good passed the tax point

Further details relating to the circumstances where the liable person may be able to amend a return, or claim a repayment will be set out in delegated legislation.

Penalties

HMRC will establish proportional penalties for non-compliance, to minimise the risk of evasion or non-compliance..

Penalties will be set out for the following offences:

- failure to notify HMRC of liability for CBAM

- failure to submit a CBAM return

- failure to pay an amount which is payable in respect of CBAM

- errors in documents which support the accounting of CBAM

- failure to disclose a tax avoidance scheme, and serial tax avoidance

- failure to comply with an information notice

In addition to the above, to ensure compliance HMRC is introducing a general regulatory penalty for failure to comply with specific rules and regulations related to CBAM. HMRC is also introducing legislation to prevent the artificial separation of business activities to prevent circumvention of the tax.

Further Information

For further information on how CBAM may impact your business and procurement strategy, please contact customs@alineacustoms.com.

[1] to allow continuity to businesses as permitted by The Greenhouse Gas Emissions Trading Scheme (Amendment) Order 2020

[2] HM Revenue and Customs, ‘Trade Data – UK Trade Info’ (Trade data – UK Trade Info) <https://www.uktradeinfo.com/trade-data/> accessed 14 April 2024